nd tax commissioner payment

You may be required to pay estimated income tax to North Dakota if you are required to pay federal estimated income tax and you expect your North Dakota net tax liability to be more than 1000. Failure to file any statement or pay any applicable tax or minimum tax filing fee by the date required subjects the company to a penalty pursuant to NDCC.

Chronology Of North Dakota Tax Commissioners

This free and secure site allows taxpayers to manage their North Dakota tax accounts from any device at any time.

. Tax Commissioner Office of the. North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a 1099G manage your Canadian refunds and more. Electronic Check You must know the routing number and account number to make a payment.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically. North Dakota Taxpayer Access Point ND TAP Refunds Visit or Mail Us Office Locations The Office of State Tax Commissioners main office is located on the 8th floor of the Capitol in Bismarck.

Welcome to the North Dakota Property Tax Information Portal. For assistance with this North Dakota Login contact the Service Desk. North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a.

You can use the online payment option to make a payment by Echeck credit card or debit card. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more. In addition to the online application applicants should upload their resume a cover letter and three professional references.

The agency also has field offices in Dickinson Fargo Grand Forks Minot and Williston. PAYMENT AND COLLECTION OF TAXES 57-20-01. You will need to have your property address statement number or parcel number in order to look up property tax information for a property.

Except as provided in section 57-20-211 the county treasurer shall allow a five percent discount to all taxpayers who shall pay all of the real estate taxes levied on any tract or parcel of real property in any one year in full on or before February fifteenth prior to the date of delinquency. Items Subject to Use Tax Line 4 on return Enter the total purchase price of tangible personal property or taxable services purchased by you for your own use on which you did not pay sales tax to your suppliers. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

Form 306 - Income Tax Withholding Return. If you are required to pay. Local Option Sales and Use Tax refer to the North Dakota Sales And Use Tax Guideline for Local Option Taxes by Location.

Application materials must be received by 1159 PM on the closing dateThe Tax Department does not offer or provide sponsorships. The North Dakota Office of State Tax Commissioner partners with Fidelity National Information Services FIS an authorized IRS payment processor to provide online tax payment services. Form 301-EF - ACH Credit Authorization.

To make an on-line tax payment click on the Research or Pay Property Taxes button below. Nd tax commissioner payment. Applications will only be accepted online through the ND PeopleSoft System.

Discount for early payment of tax. You may determine if you need to pay estimated tax to North Dakota using Form ND-1ES Estimated Income Tax Individuals. Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US.

The State Auditor has statutory responsibility to audit or review each state agency once every two years. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more. County parcel tax information can be accessed by clicking on the County of your choosing using the interactive map above.

Those counties with no color do not have online tax information.

About The North Dakota Office Of State Tax Commissioner

Kajal Aggarwal Fashion Short Sleeve Dresses Capri Pants

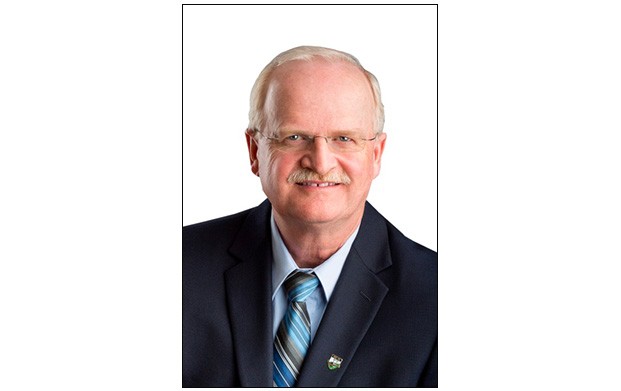

Biography Of North Dakota Tax Commissioner

Income Tax Update Special Session 2021

11 1964 The Beatles Full Unused Concert Tickets Scrapbooking Frame Reprint Set 1 Ebay The Beatles Concert Tickets Beatles Vintage

Brian Kroshus Commissioner North Dakota Office Of State Tax Commissioner Linkedin

Ndtax Department Ndtaxdepartment Twitter

North Dakota Tax Commissioner Letter Sample 1

Bible Hill Recreation Park Playground Renewal Village Of Bible Hill Nova Scotia

North Dakota Income Tax Return For 2021 In 2022 Prepare And Efile

Commissioner Of The Revenue Washington County Virginia

U S And Canada Announce New Programs For Ukrainian Refugees

Ndtax Department Ndtaxdepartment Twitter

Burgum Appoints Psc Member Brian Kroshus To Be North Dakota S Next Tax Commissioner North Dakota Office Of The Governor

High Commission Of Canada To Bangladesh In Dhaka

Chronology Of North Dakota Tax Commissioners